This article is a summary of what I read online on Barron's. I thought this was interesting to point to readers looking at Dividend play and the 2012 election cycle. The valuation, like those published exclusive on seeking Alpha, is not mine.

- Meredith Corporation (MDP) - Currently trades at $30

- Potential Upside by Industry Estimates: Approx. $5-$6 per shar

- Dividend Yield: 5.7%

- Market Capitalization: $1.36B

- Cash: $18.95M; Total debt: $250M

- Shares Outstanding: Approximately 45M

- LT Debt/ Equity:20%; Leverage:2.7x

- Sector: Services; Industry:Printing and Publishing

- Main Catalyst: 50% increase in dividend yield; 2012 Election cycle

- Trading timeline: 12 -18 months

What does MDP do?

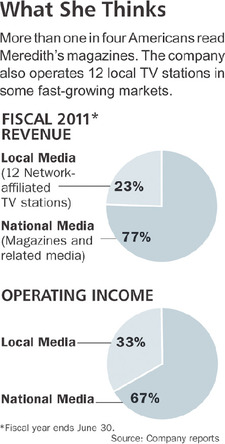

Meredith Corporation (Meredith) is a media and marketing company. The Company is engaged in magazine publishing and related brand licensing, television broadcasting, integrated marketing, interactive media, and video production related operations. The Company operates two business segments: national media and local media. The national media segment includes magazine publishing, brand licensing, integrated marketing, interactive media, database-related activities and other related operations. The local media segment consists primarily of the operations of network-affiliated television stations, related interactive media operations and video production related operations. In July 2010, the Company completed its acquisition of The Hyperfactory. In December 2010, the Company acquired Real Girls Media Network. During the fiscal year ended June 30, 2011 (fiscal 2011), Meredith relaunched Websites, including BHG.com and Recipe.com.

WHY MDP:

The shares MDP have fallen 21% in the past year, and 51% in the past four years. Then why is MDP an interesting candidate to look into? Here is why -

Potential Catalysts:

· MDP disclosed last month that it will use a chunk of its cash to boost its dividend by 50%, to $1.53 a share, resulting in a yield of 5.7%. Those looking for cash flow in addition to capital appreciation potential of MDP might find this interesting.

· Fundamentally -MDP trades at 10.2x for 2012 and under 0.9x sales—a valuation that discounts bad news and ignores some powerful drivers of future growth, including a coming tidal wave of political advertising and a recovery in food-industry ad spending. Buoyed by these trends, shares could rally to the mid-$30s in the next year, for a total return of more than 30%.

· MDP's reliance on political advertising carried by its local TV stations makes its earnings fluctuate with the election cycle. EPS is expected to fall 6% in fiscal 2012, to USD2.62, only to rise 16% in fiscal '13, to USD3.05, as spending on the 2012 elections concludes

· In a typical election year, candidates spend about $3.5 billion on TV ads, but some forecasters think the amount could double in this election cycle, given a 2010 Supreme Court ruling that loosens restrictions on corporate campaign spending. Meredith management doesn't anticipate such a surge, but the political climate suggests spending could be higher than usual. There are open U.S. Senate seats in Connecticut, Arizona and Nevada, three states where Meredith operates TV stations.

· Another potential driver for the broadcast business is the fiscal 2013 renegotiation of five-year contracts for retransmission fees, which Meredith charges cable companies to carry their signals. Citigroup expects a double-digit fee increase.

· Food advertising, which accounts for 25% of magazine-division revenue, was a weak spot in fiscal '11, as food companies faced rising commodity costs. While input prices aren't expected to drop, they are likely to level off, allowing the companies to pass through price increases to consumers. That should free up more funds for advertising.

· In addition to funding a higher dividend, Meredith will use its cash to reinvest in the business, buy back stock and focus on small, accretive acquisitions.

No comments:

Post a Comment